Business & Commercial Insurance

Coverage Built for Main Street & the Jobsite

From Main Street shops to contractors, running a business takes grit; and the right insurance. Bowerman Insurance Agency helps businesses manage risk from fire, theft, injuries, vehicle accidents, and more. Whether you operate a retail storefront, a professional office, or a service fleet, we'll design a commercial package that fits how you work and what you own.

Your Commercial Coverage Checklist

Every business is different, but the risks often look the same. See where your current insurance stands and where Bowerman Insurance can help you strengthen your protection.

Business Owners Policy (BOP)

Combined protection for property, liability, and business income

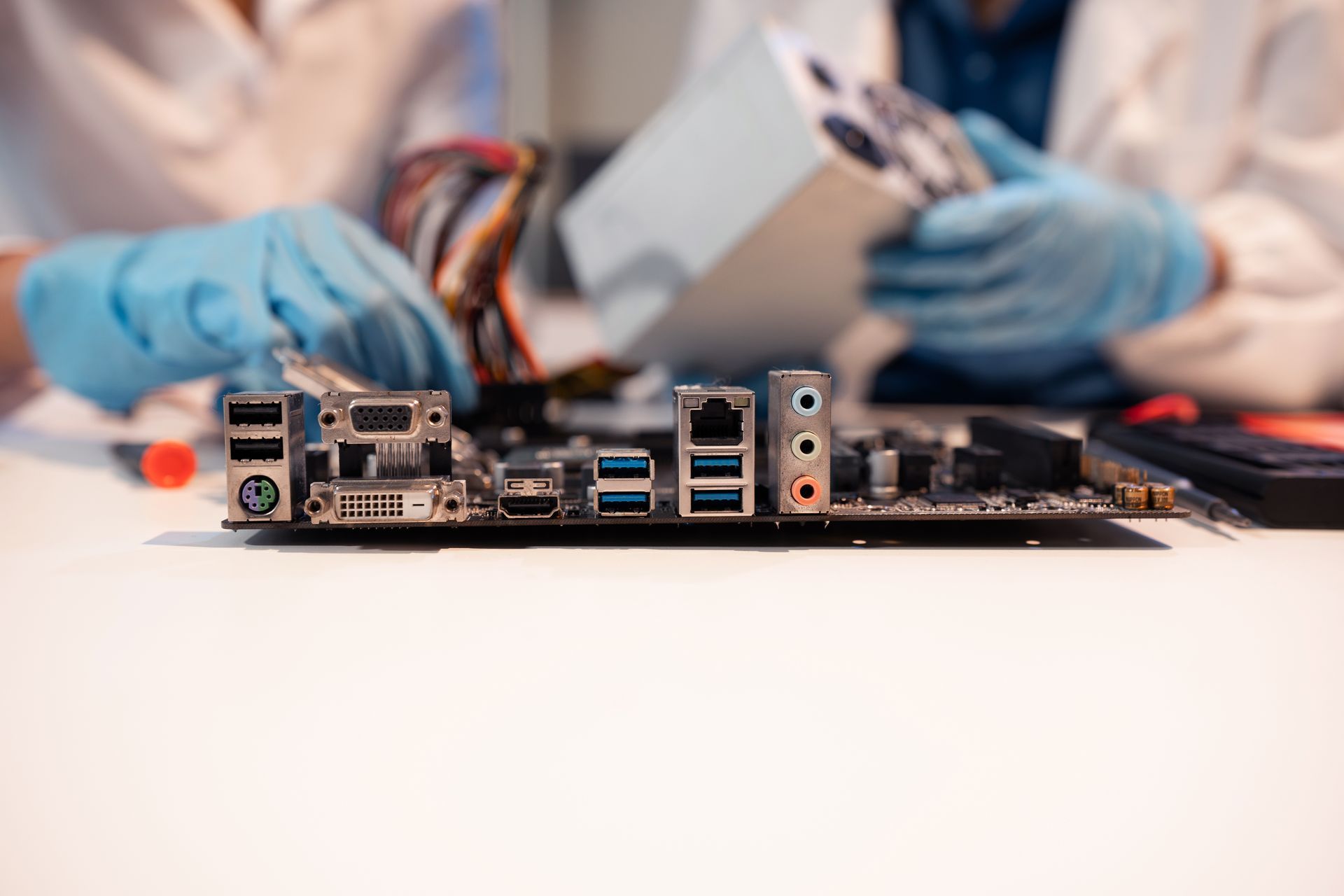

Coverage That Fits Your Trade

Retailers need inventory and equipment protection; contractors require certs, bonds, and higher liability limits; professional offices look for E&O and cyber; food and hospitality add business income and equipment breakdown. With the Gateway Insurance office in Bismarck and our team in Steele, you get convenient support plus access to multiple carriers for pricing and flexibility.

Independent Advice, 30+ Years Strong

Since 1989, Bowerman Insurance Agency has helped business owners adjust coverage as they grow; adding locations, vehicles, or payroll. We compare carriers, endorsements, and deductibles to keep your plan current, from cyber add-ons to hired/non-owned auto. Need guidance on workers' comp through a state fund? We'll help you navigate requirements and coordinate the rest of your program.

Clear Answers for Owners

What insurance is required in ND?

Requirements vary by industry; business auto is mandatory for company vehicles, and workers' comp is administered through North Dakota's state fund. We'll help you stay compliant.

Can I get one policy for a small business?

Many small businesses qualify for a BOP combining property and liability-often with cost savings.

How are premiums determined?

By factors like business type, location, revenue, payroll, claims history, and chosen limits. We'll shop multiple carriers.

Do you provide bonds for contractors?

Yes, we place license and project bonds and can turn them around quickly.